Online finance courses? Hear me out – you may not think this is the place for you, especially if word problems involving “X” amount of apples make your head spin. Or maybe you’re already a master with numbers and spreadsheets, but you’re looking for that extra edge to up your finance game. Regardless of your experience, financial knowledge is not only essential but can also build new opportunities in your career. The best part? It’s now easier than ever to get a grasp on finance without going back to school, thanks to the world of online courses.

Let’s face it – the world of finance can be a maze of jargon and complex subjects, from budgeting and saving to investing and taxes. But, fear not! We’ve compiled a list of online finance courses that will cater to all levels of expertise and truly understand the ins and outs of managing your finances. Dive into our curated selection of engaging and informative courses that’ll have you feeling like a seasoned analyst in no time, while fitting conveniently within your busy life.

Finance Courses – Table of Contents

- The Complete Financial Analyst Course 2023

- Finance for Non-Finance: Learn Quick and Easy

- Introduction to Finance, Accounting, Modeling and Valuation

- MBA ASAP Corporate Finance Fundamentals for Career Success

- Corporate Finance

- Investment Analysis & Portfolio Management – Core Finance

- Financial Derivatives: A Quantitative Finance View

Disclosure: This post contains affiliate links, meaning at no additional cost for you, we may earn a commission if you click the link and purchase.

The Complete Financial Analyst Course 2023

Platform:

Udemy

Rating:

4.6 out of 5

Looking to take your finance career to the next level? The Complete Financial Analyst Course is just the ticket! Praised by Business Insider and Forbes, this comprehensive, dynamic, and practical online course covers everything an aspiring financial analyst needs to know. Among the topics included are Microsoft Excel for beginner and intermediate users, accounting, financial statements and ratios, finance basics, business analysis, capital budgeting, and Microsoft PowerPoint for beginner and intermediate users. These topics ensure you’ll receive the proper training for each critical aspect of the role.

But this course isn’t just about learning; it’s about putting your newfound skills to the test! Throughout the course, you’ll tackle challenges such as calculating a company’s sales in Excel, analyzing business performance, and creating PowerPoint presentations based on the results. The best part? You’ll receive personalized feedback to optimize your learning experience and even have a chance to participate in a monthly Amazon Gift Card Lottery. With high-quality production, knowledgeable instructors, and excellent support, the Complete Financial Analyst Course will help you secure a well-paid, in-demand job with room for growth and promotions. Don’t miss your chance to invest in your future – enroll today!

Skills you’ll learn in this course:

- Proficiency in Microsoft Excel for productivity and data analysis

- Understanding accounting, financial statements, and ratios

- Knowledge of finance basics, including interest rates and financial math calculations

- Business analysis skills and industry knowledge

- Competence in capital budgeting and project feasibility

- Proficiency in Microsoft PowerPoint for visual presentations

- Ability to analyze company performance and create reports

- Effective problem-solving skills to tackle financial challenges

Finance for Non-Finance: Learn Quick and Easy

Platform:

Udemy

Rating:

4.6 out of 5

Are you ready to master finance concepts without turning to books, endless web searches, or lengthy, dull courses? This online course was designed for non-financial managers seeking a raise or a better job, as well as small business owners aiming to measure and improve their business performance. With only 4-5 hours of commitment, you’ll enjoy 30 lectures, 2.5 hours of high-quality animated video content, and practical exercises and quizzes throughout the course. Analyze the financials of renowned companies like Apple, Facebook, and Ford while receiving full and responsive support from the course team. Handouts of all course materials are also provided to facilitate easy studying and retention. Plus, there’s a 30-day money-back guarantee!

This user-friendly course is designed in an explainer video format to deliver financial fundamentals in an easily understandable manner. You’ll receive detailed explanations, practical cases, and quizzes to test your knowledge. Dive into accounting basics and learn to understand financial statements as you complete the course within 4-5 hours. Boost your business and financial literacy to make more informed economic decisions. Gain insights into financial reports, including Balance Sheet, Income Statement, and Cash Flow – essential knowledge for success in any business. Have fun analyzing the financial statements of corporate giants, create your own financial statements, devise a great budget, and learn how to run your business. The course even covers advanced topics like Zero-Based Budgeting and Cost Management. Invest your time in this fun, interesting, and highly useful course – you won’t regret it!

Skills you’ll learn in this course:

- Master finance concepts in a short amount of time

- Improve business performance by measuring key financial metrics

- Read and analyze financial statements (Balance Sheet, Income Statement, Cash Flow)

- Develop and manage a budget for your business

- Apply Zero-Based-Budgeting and Cost Management techniques

- Make well-informed economic decisions

- Interpret financial reports of companies like Apple, Facebook, and Ford

- Boost overall financial literacy and confidence in financial management

Introduction to Finance, Accounting, Modeling and Valuation

Platform:

Udemy

Rating:

4.5 out of 5

Looking to level up your skills in accounting, finance, financial modeling, and valuation? Look no further than the #1 Best Selling Accounting Course on Udemy, “Learn Finance and Accounting the Easy Way” by highly-rated professor Chris Haroun. This course is perfect for beginners, requiring no prior experience in accounting or finance. It’ll teach you how to value companies using multiple valuation methodologies that Chris has used during his Wall Street career, enabling you to come up with target prices for the firms you’re analyzing.

Throughout the course, you’ll get hands-on experience with financial statements, such as Balance Sheets, Income Statements, and Cash Flow Statements. You’ll learn best practices for creating your financial models and understand how macroeconomics plays a role in the process. Moreover, you’ll dive into the world of financial metrics and learn how to assess a company’s financial health. Chris Haroun’s engaging ‘edutainment’ teaching style will make complex topics enjoyable and easy to grasp. Don’t miss the opportunity to learn from the author of this year’s best-selling business course on Udemy, “An Entire MBA in 1 Course.”

Skills you’ll learn in this course:

- Read and analyze financial statements (Balance Sheet, Income Statement, Cash Flow Statement).

- Create financial statements using best modeling practices.

- Understand the role of macroeconomics in financial modeling.

- Research financial statements of public companies.

- Create a forecasting model from financial statements.

- List and apply commonly used valuation methods.

- Derive a target stock price using multiple valuation methods.

- Define and explain financial metrics to determine a company’s health.

MBA ASAP Corporate Finance Fundamentals for Career Success

Platform:

Udemy

Rating:

4.6 out of 5

Looking for a solid course on corporate finance fundamentals that’s easy to understand? The MBA ASAP Corporate Finance Fundamentals course has been highly praised by its students, who have found it engaging, informative, and an essential tool for climbing the corporate ladder. Recommended for both entrepreneurs and non-finance professionals, this course will provide you with a framework for making financial decisions by exploring the time value of money, net present value, internal rate of return, and more.

The course is based on the best-selling book MBA ASAP Understanding Corporate Finance, and it even includes an eBook version of it! Corporate finance concepts can be mysterious, but this course simplifies them so you can grasp them with confidence. You’ll learn about the valuation of companies and assets, cost-benefit analysis, breakeven calculations, and many other essential concepts. By understanding corporate finance, you’ll be able to make better business decisions and evaluate performance effectively. Grab this opportunity to invest in your financial intelligence and acquire a critical skill set for professional growth.

Skills you’ll learn in this course:

- Understand the time value of money

- Develop tools for making good financial decisions

- Assess risk vs. return trade-offs

- Value income-producing assets and companies

- Analyze financial statements and ratios

- Perform cost-benefit analyses

- Calculate breakeven points and leverage

- Evaluate internal controls in business

Corporate Finance

Platform:

Udemy

Rating:

4.6 out of 5

If you’re looking to gain a better understanding of financial statements and how to use them for decision making, this course is perfect for you. You’ll be diving into the fascinating world of ratio analysis, a highly valuable skill across numerous fields. By mastering ratio analysis, you’ll learn to assess the performance of not only individuals in various work environments but also corporations. Ready to up your analytical game and make more informed decisions? Get ready for this insightful course!

Throughout the course, you can expect to tackle example problems in both presentation and spreadsheet formats. Corporate finance is the ideal arena for honing your Excel or Google Sheets skills. Each practice problem comes complete with a downloadable Excel file, which you can also open using Google Sheets. And worry not – these files contain both an answer sheet and a preformatted worksheet for you to fill in as you follow along with step-by-step instructional videos provided in the course. So, gear up for an enriching and interactive learning experience where you’ll sharpen your corporate finance knowledge and excel at spreadsheets!

Skills you’ll learn in this course:

- Reading and understanding financial statements.

- Applying ratio analysis for decision making.

- Measuring job performance using ratio analysis.

- Analyzing corporate performance.

- Predicting future performance of corporations.

- Enhancing problem-solving skills through example problems.

- Improving Excel or Google Sheets spreadsheet skills.

- Applying practical knowledge through step-by-step instructional videos.

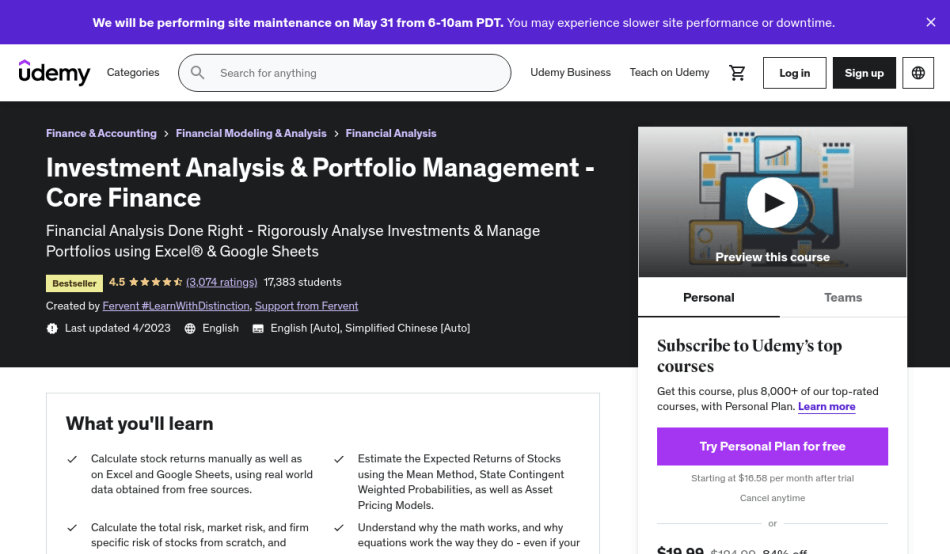

Investment Analysis & Portfolio Management – Core Finance

Platform:

Udemy

Rating:

4.5 out of 5

Welcome to a comprehensive course on Financial Analysis and Investment Portfolio Management! This course will help you master advanced investment analysis and management techniques, all grounded in both academic and practitioner literature. Dive into the powerful relationships between stock prices, returns, and risks, and learn to quantify and measure your investment risk from scratch. Whether you’re a beginner or a pro, this top-notch course will walk you through manual calculations and the use of Excel® and Google Sheets with real-world data, ensuring you fully comprehend the subject matter.

The course covers six core sections, including an introduction to estimating returns, understanding and measuring risks and relationships, measuring portfolio risks and returns, exploring diversification and optimisation, and decomposing diversification. Throughout the course, you’ll enjoy our tried-and-tested teaching techniques, a solid foundation of core principles, example question walkthroughs, over 150 practice questions, and extensive resources such as cheat sheets and mathematical proofs. Say goodbye to information overload and watch your confidence grow as you tackle progressively challenging concepts and questions, designed for distinction and curated by Russell Group tutors. Enroll now and get ready to conduct your own financial analysis and manage portfolios like a pro!

Skills you’ll learn in this course:

- Mastering sophisticated investment analysis and portfolio management techniques.

- Quantifying and measuring investment risk.

- Estimating stock returns for dividend and non-dividend paying stocks.

- Estimating expected returns using various methods, including CAPM.

- Understanding and measuring risk and relationships between securities.

- Estimating the return and risk of multi-asset portfolios.

- Optimizing portfolio weights to achieve a target expected return and minimize risk.

- Decomposing diversification and understanding the fundamentals behind it.

Financial Derivatives: A Quantitative Finance View

Platform:

Udemy

Rating:

4.7 out of 5

Are you interested in a lucrative and rewarding career in quantitative finance? This online course is designed to be a gateway into the quant world, helping you master quantitative finance and the financial engineering of derivatives, the most influential class of financial products in today’s market. The instructor, a mathematician and financial quant with a Ph.D. from the Courant Institute of Mathematical Sciences at NYU, focuses on the practical skills you’ll need in the real world of finance, drawing from his 10 years of college teaching experience.

Throughout the course, you’ll gain a deep understanding of the fundamental derivative structures traded on markets today, including forwards, futures, swaps, and options. The course also covers topics like risk management principles, futures hedging, stochastic processes, and option pricing models such as the Black-Scholes theory. The best part? You don’t need an extensive background in finance to succeed – a strong quantitative background and basic knowledge of statistics and calculus will suffice. Plus, the course now provides Python-based tools for computations with bonds, yield curves, and options, giving you the tools you need to thrive in the finance industry. Sign up for this comprehensive course, equivalent to a full semester college course, at a fraction of the price and with a 30-day money-back guarantee.

Skills you’ll learn in this course:

- Master quantitative finance and financial engineering of derivatives

- Gain a deep understanding of forwards, futures, swaps, and options

- Learn how derivatives are used for speculation and risk management

- Understand interest rate fundamentals and discounted cash flow analysis

- Analyze bonds and explore portfolio modeling

- Acquire knowledge of stochastic processes and time series concepts

- Familiarize with log-normal model of asset prices and option pricing theories

- Implement Python-based tools for financial computations in your career

In conclusion, taking the leap to improve your financial skills through online courses can be not only eye-opening but empowering as well. With numerous different platforms providing courses tailored for various skill levels and fields of focus, there’s undoubtedly a course out there that matches your needs. By allocating just a bit of your time, you can gain the necessary skills to make better financial decisions, manage your personal finance, or even embark on a new, successful career path in finance.

Don’t let the ocean of financial jargon and complex concepts overwhelm you. Remember, taking small steps, being patient with the learning process, and staying committed are key. So put on your virtual learning cap, dive into those online finance courses, and take charge of your financial future. You’ll be amazed at the doors that open and the confidence you gain as you become more financially literate and savvy. Give yourself the gift of a brighter financial future and start exploring those online finance courses today!