Oh, hey there! Let me guess, you’ve gotten a taste of the exciting world of financial technology, and now you’re craving more, right? I know the feeling – Fintech is an ever-evolving landscape that has managed to shake up traditional banking and financial systems like a seasoned mixologist. Sounds pretty exhilarating, right? So, if you’re looking to become the next FinTech whiz, then worry not, because this blog post is your personal guide to finding the best online courses in the realm of financial technology.

I know you must be thinking, “But, Emma, there are soooo many options out there! How in the world am I supposed to find the right one without drowning in overwhelming acronyms and complex lingo?” Ah, my friend, that’s where I swoop in to save the day. I’ve dived deep into all corners of the internet to curate a list of the most practical and comprehensive FinTech online courses that’ll make sure you hit the ground running in this fascinating world. So sit back, relax, and let’s explore these indispensable resources together!

Fintech Courses – Table of Contents

- Digital Banking 2023 – Masterclass & Introduction to Fintech

- Open Banking, PSD2 and GDPR. FinTech

- Fintech Overview: AI, Blockchain, Cloud, Data, Cybersecurity

- How to Build a FinTech Startup with Sramana Mitra

- Fintech Frontiers-Introduction to Fintech

Disclosure: This post contains affiliate links, meaning at no additional cost for you, we may earn a commission if you click the link and purchase.

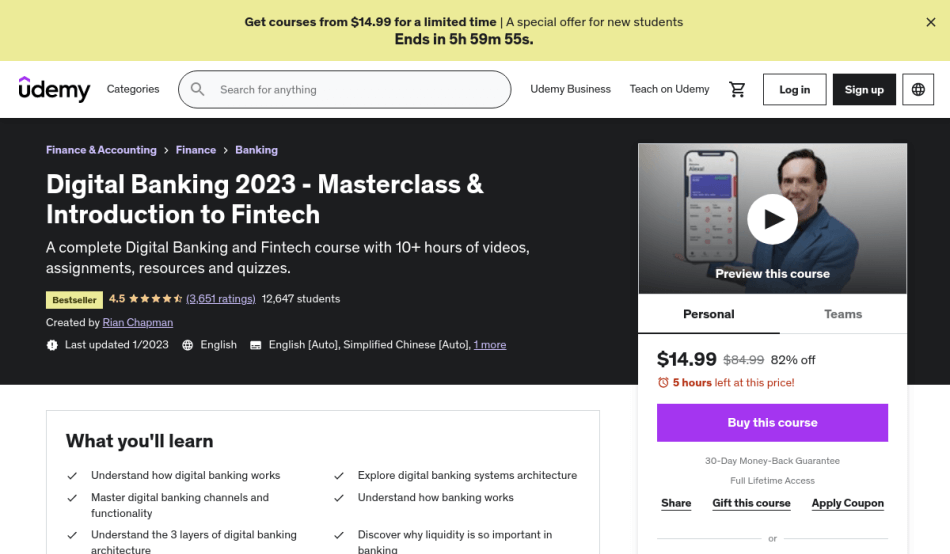

Digital Banking 2023 – Masterclass & Introduction to Fintech

Platform:

Udemy

Rating:

4.5 out of 5

Are you ready to dive into the world of digital banking and fintech? Get ready to master all the ins and outs of this exciting field in a comprehensive Udemy course that’s updated for 2023, presented by a senior product manager from one of the World’s top 100 banks! From understanding retail banking to exploring digital banking channels, architecture, and cutting-edge functionality, this course will leave you equipped to excel in the digital banking sphere. With case studies that illustrate real-world applications, you’ll become a pro in no time!

Besides acquiring essential knowledge and skills, you’ll get access to Q&A sessions with the instructor, lecture summaries, assignments, and curated resources to help you progress. With a whopping 151,000+ job listings worldwide and salaries ranging from $130,000 to $250,000+ per year, digital banking proves to be a pandemic and recession-proof career choice, with banks investing over $1 trillion in the sector. Get the inside track on this booming field, whether you’re starting fresh or enhancing your current knowledge, and forge a rewarding career path in the digital landscape. All you need is enthusiasm and curiosity – let the course handle the rest!

Skills you’ll learn in this course:

- Understand the fundamentals of retail banking and banking business models

- Comprehend and explain what digital banking is all about

- Describe the architecture and key components that make up digital banking

- Identify the key digital banking channels used by leading global banks and Fintech

- Develop strategies around digital banking functionality for improved customer experiences

- Understand and explain technology enablers in digital banking, like Big Data, AI, Cloud, and APIs

- Collaborate with delivery teams and technology experts to create digital banking experiences

- Explain what Fintech is and identify areas where it is disrupting traditional banking

Open Banking, PSD2 and GDPR. FinTech

Platform:

Udemy

Rating:

4.3 out of 5

The course offered by the Global Fintech Academy dives deep into Application Programming Interface (API), Open Banking, and PSD2, which are transforming not only the financial services industry but also many other sectors. This course is highly recommended for those in the financial services domain since it explores General Data Protection Regulation (GDPR) and how embracing fintech innovations can benefit businesses.

Throughout the course, you’ll gain valuable insights into API and Open Banking, their different types, and uses. The curriculum also covers PSD2, 2FA, AISP, PISP, PIISP, ASPSP, and XS2A Access to Account, as well as GDPR principles, rights, and penalties. Additionally, you’ll learn about the various stakeholders, benefits, opportunities, and challenges involved in payment processing, embedded finance, and Banking as a Service (BaaS). Open and API Banking are the future, and this course will prepare you to stay ahead of the curve. So, why wait? Ride the wave and forge ahead in your personal and professional journey with this insightful course.

Skills you’ll learn in this course:

- Understanding Application Programming Interface (API) and its types

- Grasping the concept of Open Banking and PSD2

- Becoming familiar with General Data Protection Regulation (GDPR) for businesses

- Learning about various stakeholders in Open and API Banking, such as AISP, PISP, PIISP, and ASPSP

- Exploring opportunities and challenges in Open Banking and API Banking

- Gaining insights into Payment Processing, embedded finance, and Banking as a Service (BaaS)

- Staying up-to-date with new legislations like NBFC Account Aggregator and Personal Data Protection Bill 2019

- Preparing for the future sharing economy and new business models in the Open/API economy.

Fintech Overview: AI, Blockchain, Cloud, Data, Cybersecurity

Platform:

Udemy

Rating:

4.4 out of 5

In this engaging crash course, you’ll dive into the world of Fintech, exploring its importance and the technologies fueling its growth. The course covers key topics such as AI, Blockchain, Cloud, and Data Analytics, with a special emphasis on Cybersecurity. By the end of the course, you’ll have a solid understanding of these technologies and feel more confident managing Fintech-related projects.

The course delves into the crucial role of the cloud in Fintech innovation, helping you understand different types of clouds and cloud service providers such as AWS, Azure, and Google Cloud. You’ll discover the distinctions between IaaS, PaaS, FaaS, and SaaS, as well as the advantages of utilizing the cloud. Additionally, you’ll learn best cybersecurity practices within the industry, ensuring you keep your financial data secure. Finally, the course will guide you through the process of migrating your projects to the cloud. This short, informative course is perfect for those looking for a quick yet comprehensive understanding of Fintech and Cloud technologies.

Skills you’ll learn in this course:

- Understanding the importance of innovation in Fintech

- Familiarity with ABCD technologies: AI, Blockchain, Cloud, and Data Analytics

- Grasping the significance of Cloud in Fintech innovation

- Differentiating between IaaS, PaaS, FaaS, and SaaS

- Identifying the advantages of using Cloud for Fintech projects

- Implementing best cybersecurity practices in the financial industry

- Successfully migrating to the cloud from a project perspective

- Efficiently innovating and ensuring security on the cloud in Fintech

How to Build a FinTech Startup with Sramana Mitra

Platform:

Udemy

Rating:

4.8 out of 5

The 1Mby1M Methodology course, led by Sramana Mitra, offers a unique opportunity for students to learn from case studies based on the experiences of tech entrepreneurs. By providing access to in-depth discussions with industry experts, the course becomes an invaluable resource for understanding the challenges and opportunities within the world of entrepreneurship. In particular, this course will focus on FinTech startups, allowing students to explore the rapid changes in the finance and banking sectors. Although the course dives deep into FinTech, learners can still benefit from the broader 1Mby1M methodology by exploring other courses offered within the program.

As the world of finance and banking continues to transform, FinTech startups have found themselves at the center of it all. This course works to help students identify opportunities within the FinTech domain by providing insightful case studies that can spark ideas and drive innovation. Concepts presented can be applied to different regions, or enhanced by incorporating new technologies. The case studies will act as catalysts for students’ thinking and ideation, allowing them to gain a better understanding of the FinTech space and determine where they want to position their ventures.

Skills you’ll learn in this course:

- In-depth understanding of the FinTech industry

- Proficiency in analyzing startup case studies

- Improved domain knowledge for successful entrepreneurship

- Ability to identify business opportunities within FinTech

- Confidence in concept arbitrage across different regions

- Creativity in enhancing existing ideas using new technologies or nuances

- Ideation and innovative thinking for positioning your venture

- Gaining valuable insights from the experiences of entrepreneurs, investors, and thought leaders

Fintech Frontiers-Introduction to Fintech

Platform:

Udemy

Rating:

4.2 out of 5

Get ready to dive into the ever-evolving world of fintech with this comprehensive and riveting course! Designed for people from all walks of life – bankers, engineers, lawyers, doctors, and students alike – this course will give you insight into the radical changes happening in the financial world that affect our daily lives. There’s never been a better time to get a grasp on the fintech landscape, and this course makes it accessible for everyone.

The course delves into cutting-edge fintech topics like Blockchain, Decentralized Finance, Crypto assets, Central Bank Digital Currencies, Digital Banking, Open Banking, Open Finance, and Buy Now, Pay Later. You’ll explore various business models and real-life applications of these disruptive trends. Plus, the course explains these complex subjects in a non-technical way with practical examples and case studies, giving you a solid understanding of key fintech concepts. Each lecture is a concise module – perfect for fitting into your busy schedule – that highlights a specific aspect of fintech with references to multinational banks, fintech companies, and global financial services regulators. Don’t miss your chance to become an expert in this exciting and rapidly changing field!

Skills you’ll learn in this course:

- Understanding the evolving fintech landscape

- Knowledge of disruptive fintech topics (Blockchain, DeFi, Crypto assets, CBDCs)

- Familiarity with digital banking, open banking, open finance, and Buy Now, Pay Later systems

- Comprehending various fintech business models and real-life applications

- Grasping complex fintech concepts in a non-technical way

- Gaining insights from practical examples and case studies

- Applying fintech concepts to various industries and professions

- Managing time efficiently by learning through compact modules

In conclusion, there’s an abundance of opportunities to expand your knowledge and skill set in the fintech industry via the array of online courses at your fingertips. Armed with your newfound expertise, you’ll be better equipped to navigate the ever-changing, fast-paced world of finance technology and stand out amongst your peers. Whether you’re a seasoned professional seeking to adapt and update your skill set, or a newbie enthusiast embarking on an innovative venture, investing time in these courses will be invaluable.

As we’ve highlighted throughout this post, fintech online courses provide the flexibility, accessibility, and tailored approach individuals crave in today’s digital landscape. Don’t hesitate to enhance your professional standing and broaden your horizons by capitalizing on these resources. Remember, staying proactive and fostering a continuous learning mindset is crucial in an industry as dynamic as fintech. So, dive in, explore your options, and kickstart your journey towards becoming a sought-after expert in the fintech arena. Happy learning!