Raise your hand if you’ve ever felt personally victimized by your own bank account. Yup, I see you and totally get it. Honestly, mastering personal finance can sometimes seem like a never-ending battle between needs, wants, and those pesky numbers that keep popping up on our account pages. But imagine if you could become a money-handling pro without having to spend a fortune on pricey financial advisors or dig through heaps of self-help books. Good news: We’ve got the solution for you in the form of online personal finance courses!

Grab your laptop (or phone, or tablet), put on your comfiest pajamas, and get ready to embark on a journey towards financial freedom built around your schedule and learning preferences. In this blog post, we’re going to dive into the top personal finance courses you can take online without breaking the bank (excuse the pun). So, whether you’re a budgeting newbie or an investment enthusiast, there’s something for everyone! Let’s get this money party started, shall we?

Personal Finance Courses – Table of Contents

- The Complete Personal Finance Course: Save,Protect,Make More

- Personal Finance Masterclass – Easy Guide to Better Finances

- Complete Practical Guide To Personal Finance For Beginners

- Personal Finance

- Best Personal Finance Course: Everything You Need to Know

- The Ultimate Guide to Personal Finance & Investing

Disclosure: This post contains affiliate links, meaning at no additional cost for you, we may earn a commission if you click the link and purchase.

The Complete Personal Finance Course: Save,Protect,Make More

Platform:

Udemy

Rating:

4.6 out of 5

Welcome to “The COMPLETE Personal Finance Course” – a thorough and comprehensive personal finance course suitable for all countries and currencies. This course, created by an award-winning business professor and Columbia University MBA Graduate, aims to help you save more money, protect more money, and make more money. With a 30-day money-back guarantee, this course covers various topics and provides more than 25 comprehensive Excel exercises to enhance your personal finance skills.

The course is divided into three sections: Save Money, Protect Money, and Make Money. From analyzing and decreasing personal expenses to understanding credit scores and estate planning, the course covers various topics to help you manage your personal finances better. In addition to personal finance topics, the course also covers investment strategies in stocks, bonds, commodities, and real estate, helping you create a diversified investment portfolio. So, if you’re ready to take your personal finance skills to the next level, this course is for you.

Skills you’ll learn in this course:

- Analyze and decrease personal expenses to increase net worth.

- Implement effective saving habits for long-term financial stability.

- Understand and improve credit scores.

- Create comprehensive budgets and estate planning strategies.

- Invest in stocks, bonds, commodities, and real estate.

- Develop a diversified investment portfolio.

- Minimize financial fees from banks and investment companies.

- Increase overall financial literacy and personal finance skills.

Personal Finance Masterclass – Easy Guide to Better Finances

Platform:

Udemy

Rating:

4.6 out of 5

Ready to revamp your personal finances and achieve financial freedom? This online course is designed to help you conquer your money hurdles and set you on the path to creating wealth for you and your family. Covering everything from understanding your money and reducing debt to investing and retirement, you’ll learn from real people who have turned their finances around and flourished. Through this course, you’ll gain the skills and knowledge to master your finances and make smarter money decisions, whether you’re in debt or just looking to grow your wealth.

Instructors Phil Ebiner, Mike, and Lauren share their financial journey and expertise, providing a relatable and practical approach to personal finance. Phil, who repaid over $140,000 in student loans and built a 6-figure business in just 5 years, offers a variety of courses, including everything from business building to video editing. Meanwhile, Mike and Lauren are on track for super-early retirement and use their personal experience to help others achieve a financially savvy lifestyle. Stop stressing and start thriving with this accessible, comprehensive personal finance course.

Skills you’ll learn in this course:

- Mastering personal budgeting and savings strategies

- Growing your income through various techniques

- Understanding and managing credit cards wisely

- Tackling loans, debt, and implementing debt reduction plans

- Grasping the basics of investing and building a portfolio

- Navigating real estate, mortgages, and big-ticket purchases

- Planning for retirement and working towards financial freedom

- Managing taxes, love and money, and the psychological aspects of personal finance

Complete Practical Guide To Personal Finance For Beginners

Platform:

Udemy

Rating:

4.8 out of 5

Are you ready to take control of your personal finances? This beginner-friendly course is designed to teach you how to manage your money, create a budget, eliminate debt, and make wise investments. You’ll learn in a step-by-step format that’s easy to follow and fun, making personal finance less confusing and overwhelming. Plus, you’ll have access to two workbooks and a variety of resources to help you reach your goals.

Through the course curriculum, you’ll cover topics such as Personal Finance 101, Calculating Your Net Worth, Budgeting, Building an Emergency Fund, Understanding Your Credit Score, and much more. By the end of the course, you’ll be equipped to establish a budget, save for emergencies, pay off debt, and start investing wisely. Students praise this course for its clear and concise content, helpful workbooks, and life-changing impact. So, what are you waiting for? Enroll today and begin your journey towards financial freedom!

Skills you’ll learn in this course:

- Creating an easy budget

- Building an emergency fund

- Paying off debt and creating a debt pay-off plan

- Understanding and improving your credit score

- Earning more money through negotiation

- Recession-proofing your finances

- Managing relationships and money

- Investing in real estate, stocks, bonds, mutual funds, ETFs, CDs, and savings

Personal Finance

Platform:

Udemy

Rating:

4.6 out of 5

Dive into the world of personal finance with this comprehensive course that covers everything from basic concepts to complex topics. Through engaging presentations and hands-on Excel worksheet problems, this course will guide you step-by-step towards mastering personal finance concepts. As a bonus, you’ll receive a downloadable Excel workbook complete with answers and preformatted worksheets, making it easy to follow along with the instructional videos.

But that’s not all! This course will also help you understand the similarities and differences between personal finance and business finance, as well as teach you how to set financial goals based on your unique life cycle and preferences. You’ll be introduced to the crucial concept of time value of money and learn how to perform present value and future value calculations. Plus, you’ll gain essential money management skills, including accounting, compiling financial data into reports, and using those reports to create effective budgets. So why wait? Embark on this valuable learning journey and equip yourself with the knowledge to make informed financial decisions.

Skills you’ll learn in this course:

- Understanding personal finance concepts, from basics to complex topics

- Gaining proficiency in using Excel for personal finance problem-solving

- Differentiating between personal finance and business finance

- Setting personal financial goals based on life situations and preferences

- Exploring the intersections of economics, accounting, and finance for personal financial planning

- Mastering time value of money calculations (present value and future value)

- Applying time value of money concepts to long-term decisions, like retirement planning

- Developing money management, accounting, and budgeting skills using financial reports

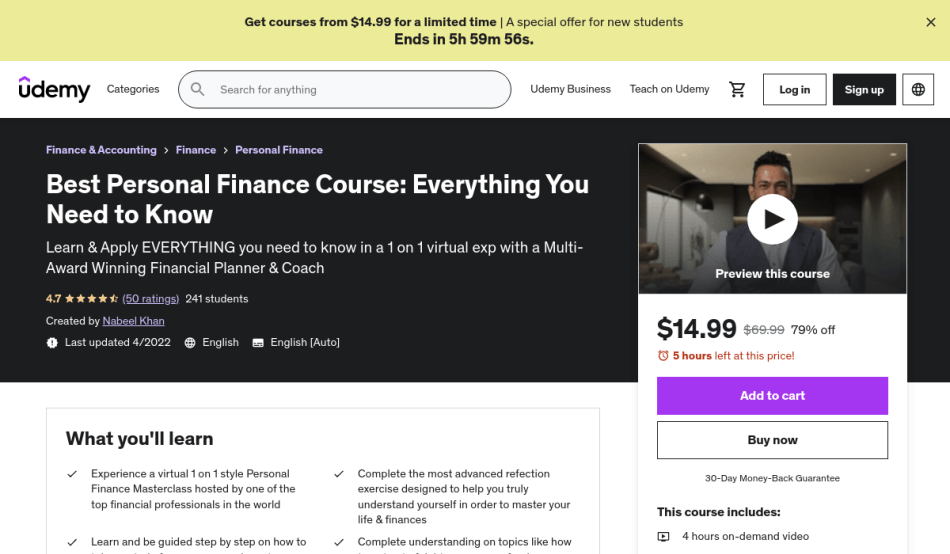

Best Personal Finance Course: Everything You Need to Know

Platform:

Udemy

Rating:

4.8 out of 5

Ready to take control of your finances and live life on your own terms? This Masterclass will teach you how to think, unlearn, and understand the principles of money management. Taught by an award-winning financial planner and coach, this comprehensive course goes beyond finance tips and helps you undergo a necessary mindset shift. You’ll build your own map to success and make better investment decisions on your journey to financial freedom.

The course includes a powerful tool called The Ultimate Freedom Calculator, which tracks your life with money, annual living budgets, mortgage payments, and more. Plus, there’s a workbook journal to help you work through the Masterclass with your instructor. All of the tools you need to save, protect, and make more are included, with real-life practical knowledge and experience at the core of the course. Say goodbye to misinformation and financial shackles, and click the “take this course” button to transform your financial future. Share or gift this masterclass to your loved ones to help them on their path towards financial freedom too!

Skills you’ll learn in this course:

- Money management principles and practical application

- Building a personalized map to financial success

- Saving money on insurance and expenses

- Making better investment decisions

- Understanding and improving credit scores

- Mortgage payment calculation and early payoff strategies

- Creating a diversified investment portfolio

- Navigating financial institutions and minimizing fees

The Ultimate Guide to Personal Finance & Investing

Platform:

Udemy

Rating:

4.4 out of 5

Looking to get started with personal finance and investing but feeling overwhelmed by jargon and complicated concepts? Ajay’s beginner-friendly course is perfect for you. Designed to simplify the world of money and investments, this course tackles the most important aspects of finance in easy-to-understand modules. You’ll go from feeling confused and hesitant to becoming a savvy investor ready to make financial decisions with confidence.

Throughout the course, Ajay will guide you step by step, helping you grasp financial markets, asset classes and allocation, saving money efficiently, and ultimately achieving financial freedom. By the end of your journey, you’ll have a clear understanding of personal finance and investing, and be on the right path to growing your wealth. So, forget about daunting formulas and numbers and embrace this fun, simple, and classroom-like learning experience. Here’s to a bright financial future ahead!

Skills you’ll learn in this course:

- Personal finance and financial freedom

- Understanding the financial markets in India

- Familiarity with various asset classes in India

- Asset allocation strategies based on age

- Efficient money-saving techniques

- Overcoming fear of financial jargon

- Confidence in starting your investment journey

- Adopting a fun and easy approach to learning about money and investing

In conclusion, personal finance online courses are an invaluable investment in one’s financial well-being. With a plethora of courses available, designed to help people navigate various aspects of their financial lives such as budgeting, investing, and retirement planning, there’s never been a better time to take charge of your own financial education. The numerous courses at your fingertips cater to all levels of expertise, meaning it’s never too late (or too early) to start learning how to manage your money smartly.

While e-learning platforms have made it easier than ever before to access quality personal finance education, it’s also essential to do your due diligence in selecting the courses that best cater to your needs and goals. Remember to consider factors such as course content, instructors’ reputation, and user reviews when assessing your options. By investing time and energy into the right personal finance online course, you’ll be able to build a more secure, financially savvy future for yourself and your loved ones. So go ahead, dive into the world of personal finance courses, and watch your knowledge (and bank account) flourish.